Registration forecasting for 2023 was the top challenge identified by Louisville Tourism’s Client Advisory Council members. (Adobe Stock Photo)

Christine “Shimo” Shimasaki, CDME, CMP

Last year, when the Louisville Tourism and their Client Advisory Council (CAC) met to discuss what industry challenges they wanted to address from both a planner and supplier perspective, registration forecasting rose to the top. Given that 2022 was the first year many in-person events returned after the pandemic, continued uncertainties around COVID, consumer behaviors, and economic constraints made it difficult for CAC planners to predict how many attendees and exhibitors would register to travel to their events.

So, during their time together last year, Louisville Tourism and its CAC — 24 association, corporate, trade-show, and special event meeting professionals who serve a two-year term — focused on registration data analysis and best communication and collaboration practices around these numbers to aid in industry recovery. The assessment included analysis of CAC members’ registration data, insights discovered about attendee behavior, and suggestions for how and when this information should be communicated. What the group learned can be broken down into 3 P’s: Participants, Patterns, and Partners — a framework that can help you rethink your upcoming in-person registration strategy.

PARTICIPANTS

When looking at registration numbers, overall attendance is the most obvious measure of event success. To drive that success, begin by examining what you understand about the participants and how they can be categorized. What percent are exhibitors? What percent are organization members vs. non-members? One CAC member’s event draws a lot of non-members whose registration pattern is much more unpredictable than members. For this planner, looking at the timing around when members and exhibitors have registered has shed light on the value of early-bird registration incentives.

Other questions the group considered when looking at registration data analysis include:

- What percentage of our members attends and is there room to grow this?

- Are there specific audience segments that are — or should be — growing based on our membership or demographics?

- Are we putting a detailed plan together to address declining groups?

- Are we attracting our target audience, and does our event program serve the individual needs of those in attendance?

The answers may surprise us if we put our assumptions to the test. Technology, workforce demographics, and content formats are having a direct effect on attendance. The past three years have accelerated our digital skills and how we communicate and consume content. Plus, content channels have proliferated while our attention span has grown much shorter. We also have Gen Z, the first generation to have grown up entirely in the digital era, entering the workforce. These factors raise additional questions:

- Who is coming to our digital vs. in-person meetings?

- Are we tailoring or segmenting our marketing messages to these various groups?

- What are the key motivators for each group?

- What information are we gathering about our attendees’ preferences?

- How user friendly is our registration process and are we allowing our attendees to choose their event experience?

- How many people start the registration process without making it to the checkout button, and what potential barriers can we remove?

Once we know who the participants are, we can design content and meaningful experiences to best serve and drive value for them — “keeping engagement and involvement high is the key to our success and the livelihood of our organization,” said CAC member Marisa Villalba, senior event planner at American College of Surgeons.

From “Louisville Tourism CAC Project:

Exploring the Analysis of Event Registration”

PATTERNS

Planning and forecasting seemed nearly impossible going into 2022, but it is possible to discern registration patterns for events held last year. Analyzing registration data even during times of uncertainty can help us identify our group’s behaviors and preferences and spot any new trends that may be occurring.

As a membership-based organization, the American College of Surgeons seeks to understand “why a person attends the meetings but does not join the organization,” Villalba said. What triggers could deepen engagement in the organization and get them to volunteer? Looking for patterns can also reveal insights into when segments typically register — whether early or late — and how specific offers and pricing incentives impact registration behavior.

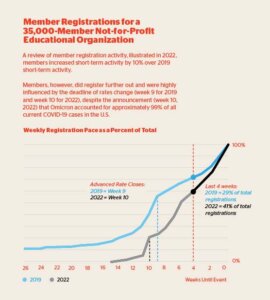

Historically, we’ve seen increases in registration numbers when there’s a deadline, along with an increasing trend of last-minute registrations (see chart on p. XX). CAC member Gretchen Bliss, director of meetings and conferences at Healthcare Financial Management Association, expressed a concern common among planners and suppliers — how a large number of registrants are waiting until the last minute to make a commitment and the domino effect these late registrations have on the planning process. From an analysis standpoint, calculating the rate of change, especially for the last four weeks prior to the event date, allows comparison to a previous year.

Understanding registration patterns enables the Association of Equipment Manufacturers, where CAC member John Rozum serves as senior director of ag & utility exhibitions and events, “to get to a point where predictive analytics can determine not only who is at the show and how they behave but take it a step further and understand buyer intentions and purchasing habits,” he said. “Combining registration data with on-site beacon analytics, and post-show surveys to ultimately tie into purchasing habits is ultimately where we’re headed.”

PARTNERS

Once we understand the participants and the patterns of our group, the next question becomes: What does it take to be a good partner to our host destination, hotel, or clients? Just as in any relationship, communication that flows both ways is vital. The CAC’s discussions throughout last year highlighted that historically there have been gaps in timely communication between planners and suppliers.

Without timely communication of the right information, one side prevents the other side from seeing a piece of this large event puzzle. What do “timely” and “right information” mean? While there’s no standard definition for either, organizers should think in terms of touchpoints leading up to their event — like letting your CVB and/or hotel contacts know dates for major marketing eblasts and announcements about headliners or keynotes, deadlines for event price increases, as well as information about your typical group registration behaviors and preferences, to name a few.

This is important information to share with your hotel and DMO partners, so they know when to expect increases in your registration and hotel pickup. Doug Bennett, Louisville Tourism’s executive vice president, also suggests scheduling pre-event audits with the hotel at eight, six, and four weeks before the event starts, along with inside 30 days. You may be able to identify and capture additional pickup early if participants booked outside of your block.

Doing so also allows hotels to adjust staffing and budget projections and communicate internally to their stakeholders. Each hotel’s business mix is different, as is its reliance on group business. Once a hotel has presented its expected projections of an event to its owners and stakeholders, it’s challenging for them to make accommodations for a group after they’ve significantly underperformed based on expectations spelled out in the original contract. However, this proactive communication allows the hotel to adjust their forecasting and gives them time to potentially find another group to fill the gap — enabling allowing partners to lean on each other to mitigate their event risk.

Communicating With Partners

In addition to making their organizations less liable for penalties and enabling hotels to better anticipate staffing needs, when planners regularly share their registration data with their partners, they are rebuilding their event’s history and credibility, said Sonia Fong, senior VP of convention development at Louisville Tourism.

Another benefit to communicating registration data with CVBs, Louisville Tourism’s Doug Bennett said, is that they can assist planners in determining the value of their event. Using only the event participants’ ZIP code, DMOs can help planners look at the distance each participant travels, figure out whether they booked in the group block, and get a better sense of an event’s true economic impact on a city. Knowing your group’s economic impact and rebuilding your event’s history can be beneficial in sourcing — and negotiating in — your next host destination.

Christine “Shimo” Shimasaki, CDME, CMP, is the Customer Advisory Board (CAB) facilitator and senior strategist at MYB, a business consultancy focused on associations.