A study by Juniper Research revealed that the value of virtual card spending will hit $6.8 trillion in 2026, a 370 percent increase from 2021. About 71 percent of this volume will come from B2B financial interactions, including those done in travel. This article explores the benefits virtual cards bring to the table and what a travel company should consider when implementing this method.

Virtual credit cards in travel explained

What are virtual cards?

A virtual card in B2B transactions is a payment option linked to a real card account and typically issued to pay a specific amount of money in a desired currency to a particular recipient. Each time, a virtual card comes with a unique 15- or 16-digit virtual card number (VCN) and expiry date, ceasing to function when its goal is achieved.

The main selling point of a virtual card lies in enhanced security and control over spending. It can be generated for

- a single transaction or a particular purchase, with a limited amount to be spent;

- multiple transactions within a restricted timeframe (say, for the period of the business trip only);

- payments to a specific supplier or category of suppliers (for example, only hotels or only airlines), and

- other scenarios with a combination of restrictions.

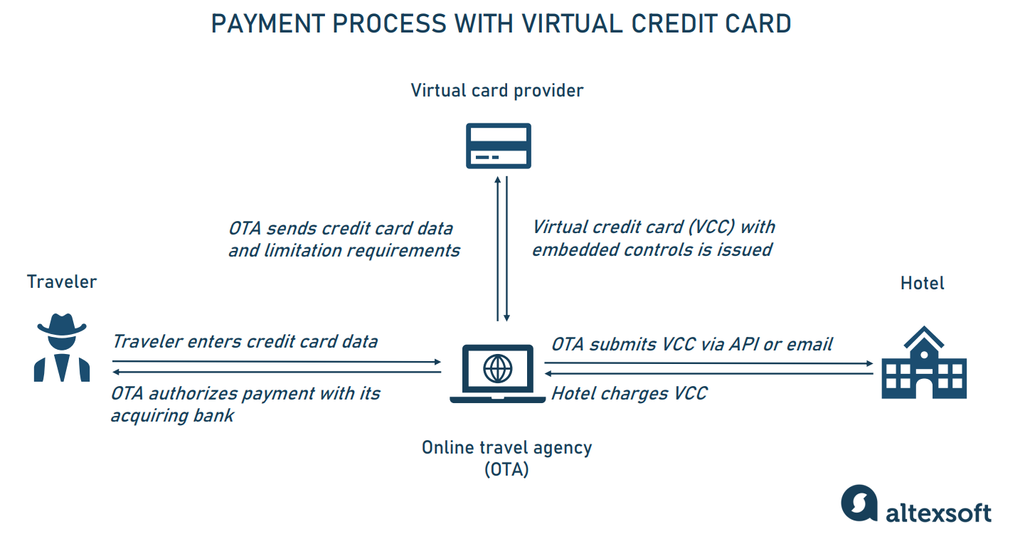

To better understand the protection mechanism, let’s look into one of the possible flows where an online travel agency (OTA) uses a virtual credit card (VCC) to pay the price of a hotel room.

How a payment process with VCCs may look like.

- A traveler books a room for two nights via OTA and provides credit card information to pay $100 for the stay.

- The OTA authorizes the payment with its acquiring bank.

- The OTA forwards payment details via API to a virtual card provider, initiating issuance of a virtual card with certain settings — such as a restricted amount of money (for example, a hotel can charge no more than a negotiated room rate — in our case, it will be $100 minus OTA commissions).

- The virtual card provider returns a 16-digit VCN, CVC code, and expiration date substituting the guest’s credit card details.

- The OTA pushes the VCC representation along with booking confirmation to the hotel via API or email.

- The hotel charges the VCC instantly, after check-in or on check-out — depending on the cancelation policy and agreements with the OTA (for instance, Booking.com activates its VCCs one day after check-in.

- The VCC automatically expires once the transaction is completed.

Of course, this scenario is very rough, with many details missing. Besides, the flow can largely vary depending on the type of virtual card provider, conditions negotiated with a supplier, and many other things. But in any case, a hotel will never know the guest’s credit card information. And since the VCC has a lot of restrictions and becomes invalid once the charge is made, its exposure to fraud is relatively small.

Virtual card benefits and pitfalls

Virtual cards appeared as a new anti-fraud measure at the end of the 1990s. Their creator, the Irish payment processing company Orbiscom was later acquired by Mastercard. Still not common for end consumers, the approach gained traction in business-to-business relationships, particularly in fleet management and B2B travel sales.

Among the main beneficiaries of the method are travel management companies (TMCs) and OTAs who act as a merchant of record — in other words, accept payments of end travelers before distributing money across suppliers.

Learn more about OTA payment models and scenarios from our article on travel payment integrations for resellers.

Even with the staggering forecasts reflecting the worldwide spiraling of virtual card transactions, data shows that travel suppliers are often reluctant to deal with VCCs. "The VCC adoption by OTAs like Booking.com and Agoda hits 65 to 70 percent," says Koert Grasveld, Vice-President of Payments in TerraPay, a global payment platform with a high focus on Travel and Payroll. “But looking at the number of properties they sell online, there is still a large gap, the gap that will continue to grow with the increasing number of alternative accommodations that are being connected to such platforms.”

Other vendors, from sightseeing tour companies to airlines to cruise lines, are also not big fans of VCCs — and for a reason. The exception here is car rental companies, with a level of VCC adoption nearing 80 percent, all due to well-organized financial systems and processes that can handle virtual cards. Yet, on average, Koert Grasveld estimates VCC acceptance in the industry as low, “closer to 40 or even 30 percent.”

Below, we’ll explore the advantages of virtual cards over other payment methods — along with pitfalls that make this mechanism unattractive for certain travel businesses.

Virtual cards pros

Virtual cards inherited all the advantageous traits of regular plastic, including wide use, no need for cash and checks, and fraud prevention measures offered by major card brands. At the same time, they come with additional pros that dramatically streamline B2B payment flows.

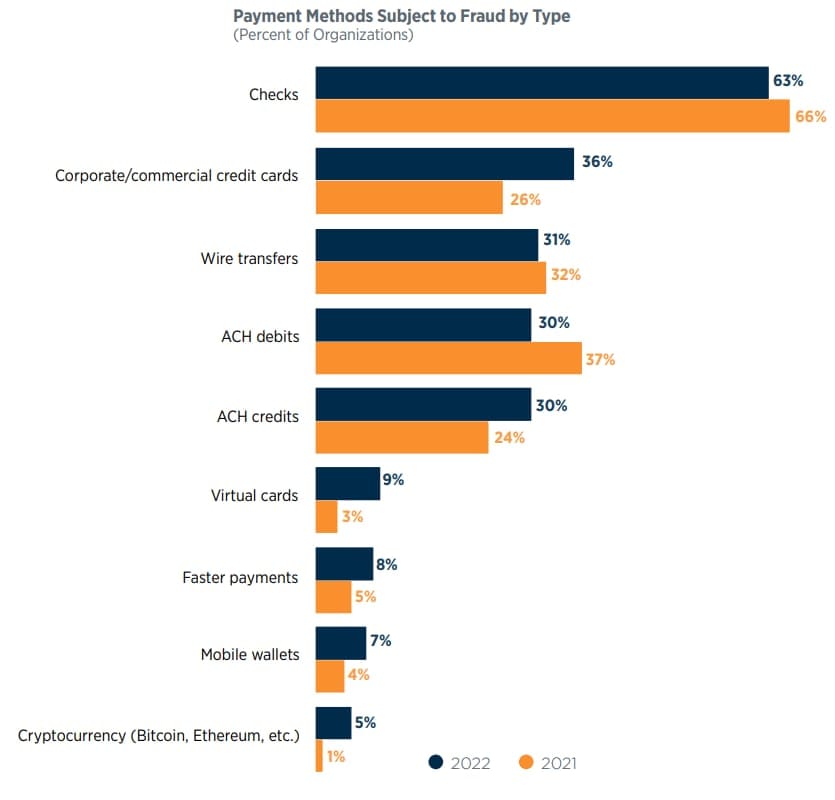

Advanced fraud protection. Unlike a plastic counterpart with never changing information printed on it, a VCC has new verification data each time you apply it, so you avoid exposing details about an actual bank account. Besides that, specific controls, like a spending limit or validity period, can be set up to reduce the risk of fraud. All these measures contribute to the security of transactions made with VCCs, alleviating the burden of sensitive data protection and PCI DSS compliance.

According to the 2023 Payment Fraud and Control Survey Report by the Association for Financial Professionals (AFP), virtual cards are less vulnerable to scams than traditional methods, with just 9 percent of businesses becoming subject to fraud when using this payment mechanism. At the same time, the share of organizations suffering criminal attacks amounts to

- 63 percent via checks,

- 36 percent via corporate credit cards,

- 31 percent via wire transfers, and

- 30 percent via ACH debits and credits

It’s worth noting, though, that virtual card fraud has increased by 6 percent since 2021.

The list of payment methods most vulnerable to fraud. Source: Association for Financial Professionals

Hassle-free implementation. A VCC is processed the same way as any other card transaction. “The key thing here is that it all happens on the existing rails,” stresses Paul van Alfen, Travel Payment Strategist and Managing Director at Up in the Air, a travel payment consultancy company. “So, you don’t have to come up with new workflows, reporting, reconciliation procedures, and so on. Virtual cards don’t disrupt the legacy processes, which is very important.” In most cases, VCCs can be easily integrated into a company’s systems — for example, a corporate booking tool or OTA’s back-office software.

Ease of issuance and flexibility. Virtual cards are issued and blocked in a wink via API calls. “They can be generated on the spot, activated for a certain amount of money in a certain currency at a certain time for a certain merchant,” Paul van Alfen adds. “So, there’s a lot of flexibility. You can really target a one-off payment or multiple payments to suppliers.”

Speed of transactions. In the US, checks remain a prevailing method of B2B transactions. It takes up to seven business days to process a paper check, which sometimes must be physically delivered to the bank. But even with modern imaging technologies that allow banks to use pictures of checks, you need to wait until the next working day to get the funds cleared. Virtual cards, by contrast, enable almost instant payments.

The protection against supplier bankruptcy. In the case of supplier bankruptcy, you are much more comfortable with a VCC because it has all advantages of a credit card. “It basically covers everything.” Koert Grasveld explains. ”With a bank transfer, you don’t have that. Will you get your money returned? You don’t know. And if you are a merchant of record, you have to take the hit and pay your consumer — so, it’s out of the pocket expense. Mobile wallet transactions have the same limitations here.”

This advantage is especially relevant when it comes to selling flights since, as Koert puts it, “if a hotel goes bankrupt, the property still remains, and people might have the option to travel there. But when it’s an airline, they would definitely want to have their money returned.”

Control over spending. As mentioned above, virtual cards can be tied to a specific vendor, transaction, or staff member. This provides a robust way to track who pays whom and for what. Also, with pre-defined limits in place, it’s easy to prevent card misuse. Information on purchases made with VCCs gets logged into the expense management system, so each money flow is easily traced back. This data allows you to analyze spending in detail and make informed budget decisions.

Process automation and no more manual reconciliation. Virtual cards automate the end-to-end B2B payment flow, reducing manual work and decreasing processing costs by up to 70 percent. For example, a traveling employee who pays with a virtual card doesn’t need to gather receipts since all expenses will be automatically captured. For OTAs, unique card numbers assigned to each transaction also eliminate the need for manual reconciliation.

Rebates. To attract customers, many virtual card providers offer rebates ranging from one to two percent of the overall transaction value. So the more virtual card transactions you initiate, the more you earn. Note, though, that the rewards you get as a travel agency are withdrawn from interchange fees paid by your suppliers. Which, from their perspective, is hardly an advantage and rather the opposite.

Also, VCCs have a positive impact on generating sales and improve cashflow for both agencies and suppliers. What is also worth mentioning is that some virtual card providers offer credit lines for sellers.

Virtual cards cons

Travel intermediaries are the ones who obviously benefit from using virtual cards. But all is not so rosy for suppliers — or companies who have to accept those payments. Let’s see why.

High interchange fees. As we said, travel agencies can earn money on rebates offered by VCC providers. For suppliers, VCCs are associated with high interchange fees charged by a card-issuing bank for the acceptance of card-based payments.

The interchange depends on the card network, the type of card, the country, and other factors, taking about two-thirds of the total cost of online payment processing. And virtual cards involve even more operations, which results in soaring prices.

“A lot of airlines have policies that just block virtual cards because they disagree with the price tag,” Paul van Alfen explains. “Bear in mind that they compare those costs with 8 cents per ticket in direct costs taken by the legacy IATA clearing house (Billing and Settlement Plan or BSP. — AltexSoft.) which is, per definition, an apples vs oranges comparison.”

The lack of VCC payment infrastructure and knowledge. To accept virtual cards, suppliers need tools in place along with staff trained to use VCNs. “If you have a plastic card, you’ll just tap or swipe it, but it’s impossible with a virtual card,” Koert Grasveld points out. “VCCs require more knowledge at a car rental or hotel front desk. Then, of course, you can’t handle the payment if a terminal doesn’t allow you to type in a card number. So there’s a lot of friction on the acceptor’s side.”

Usage complexities. Controls embedded in virtual cards can pose certain problems for suppliers. Instead of following the normal payment process, they need to accommodate to requirements of each booking platform offering VCCs. Short expiry dates and other limitations may result in additional workload. “For instance, cruise lines are not into VCCs simply because they have a long travel window. After the first payment, they do the second half of the transaction a couple of months later, and virtual cards are a complicated mechanism for this scenario,” Koert says.

All the above-mentioned lead to overall lower market coverage — if compared with traditional consumer or corporate cards accepted globally by default. But if, despite pitfalls, you are a travel reseller who appreciates all the good things VCCs offer, the next step is to choose the right virtual card provider.

How to choose the right virtual card partner

The landscape of virtual card vendors is really diverse. To make the best possible choice, you must clearly define your own business needs in the first place — and align them with those of your suppliers and the markets you serve.

VCC vendor selection criteria

Here are key parameters you should keep in mind when considering a future VCC partner. While this list is not exhaustive, hopefully, it will help you narrow down options.

Acceptance threshold. Big providers — like WEX, Conferma Pay, or Outpayce from Amadeus — often seek to work with equally large enterprises, setting requirements for payment processing volumes at millions of transactions annually. New players are unlikely to meet this criterion in the foreseeable future, so they simply can’t strike a deal with giants.

Supported currencies. Currencies accepted by hotels or car rentals you work with may differ from those in which VCCs are generated. So, it’s crucial to keep in mind where your key suppliers are located and what options are available to issue virtual cards and settle them. Here, global players can stick to the rule “the more, the better.” However, “If you’re very US-centric, and you work with US hotels only, you probably don’t need a partner with dozens of different currencies,” — Koert Grasveld suggests.

Rebates and interchange levels. As an intermediate, you’re interested in higher rebates. But don’t forget that they come at the expense of interchange fees paid by suppliers. While hotels mostly tolerate those charges, the same can’t be said about airlines. So, if a vendor doesn’t offer options with lower interchange or can not effectively articulate the benefit of VCCs to all parties, some players may just reject acceptance of virtual cards.

The granularity of restrictions. Virtual card providers are not the same in terms of the number and granularity of controls. Some platforms allow you to limit VCC usage only to a specific merchant category — for example, hotels, which is quite a large group. With others, you can set more restriction parameters within the category.

Other payment methods available via the same platform. Unfortunately, there are countries prohibiting virtual card transactions. There are territories where this method has minimal to zero acceptance. Not to mention again that many suppliers are unwilling to accept VCCs. So it never hurts to have alternative B2B payment options — like bank transfers and digital wallets — in place. Ideally, you would access other methods with the same platform via a single API, saving on costly integration and maintenance of additional connections.

Digital card provider examples

We picked several virtual card providers well-established in the travel industry and briefly described their offerings to give you an idea of the abilities of potential payment partners. Obviously, you have to do your own thorough research to consider these and other variants which may be better for you.

Examples of virtual card providers and their offerings.

WEX, a corporate payment solution provider with 40 years of history, handles more than 100 million virtual card transactions across 200 countries annually. The platform issues Mastercard and Visa VCCs in 120+ currencies and leverages around 20 currencies for local settlement.

A pioneer of digital cards in travel, WEX primarily caters to large players, including the world’s biggest OTAs, such as Booking.com and Expedia. But besides payment processing, the company addresses the problem of onboarding suppliers. In 2022, WEX also launched B2B digital wallet Flume to meet the needs of small and medium-sized business owners in the US.

Conferma Pay, unlike WEX, doesn’t issue cards itself. Instead, it connects 700+ TMCs, major global distribution systems (GDSs), and over 100 booking platforms to over 50 banks. Those banks release VCCs in around 100 currencies via five card brands. Two payment options available with Conferma Pay are eCommerce cards for a single transaction with a particular supplier and digital wallet cards for a particular trip. In 2022, the UK fintech company was acquired by its long-standing partner, a leading GDS in North America, Sabre.

TerraPay is a global payments infrastructure powering agile and affordable cross-border transactions. It directly links with banks in 96 countries, with no SWIFT or other third parties in the middle, allowing for almost instant payouts on bank accounts, mobile wallets, and credit cards. As for VCCs, with TerraPay, you can take advantage of 69 issuing and 34 settlement currencies, along with granular card controls.

The company is now working on a card-to-account solution that will enable travel agents and other players to pay with real and virtual cards even if they are not accepted on the receiver side. All methods offered by TerraPay are accessible via a single API integration.

ConnexPay was built with travel in mind, connecting payment issuance and acceptance in a single platform. Resellers — namely, large OTAs, tour operators, airline consolidators, and bed banks — can use inbound customer payments to fund VCCs for suppliers (airlines, hotels, railways, and others). Single- and multi-use virtual cards are issued in US and Canadian dollars, British pounds, and euros but are settled in all currencies available with Mastercard. Additionally, ConnexPay supports regular cards, Apple Pay, Google Pay, ACH transfers, and other options.

Pax2pay is another technology tailored to the specific needs of travel payments. It gained popularity among European tour operators, OTAs, flight booking platforms, and other players. Virtual cards that can be issued manually or automatically in 11 currencies lie at the heart of the solution. The platform enriches transaction reports with details like a booking reference, date of departure, operator code, and more to enable seamless reconciliation. Besides VCCs, you can also utilize swift bank transfers with Faster Payments in the UK or SEPA Instant across Europe.

Virtual cards are launched: What’s next?

It may take three to eight weeks to integrate virtual card payments into your systems — depending on the technologies you use and the resources you have. But addressing the problem of unwillingness to accept VCCs can be a much more time-consuming endeavor. This challenge can be addressed in two steps.

Introduce alternative payment options for specific markets. To determine whether virtual cards cover all your B2B transactions, you need to know who and where your suppliers are. “If you primarily work with hotels, it makes a lot of sense to go for VCCs,” Koert Grasveld assures. “Especially if your hotels are located in countries with almost 100 percent acceptance of credit cards, such as the USA. But when you enter markets like Africa or Southeast Asia, with vast unbanked regions, where people are relying on mobile wallets, then it really comes down to having a mix of solutions for different markets.”

Educate and engage your suppliers. Suppliers that never worked with virtual cards before still need to be educated and encouraged to accept VCCs. Some of them can resist this innovation — and you already know why. “A lot of work still to be done to find the middle ground where both sides of the equation (travel resellers and suppliers. — AltexSoft) will feel comfortable about virtual cards,” Paul van Alfen sums up, “Suppliers can perceive this method as overly expensive. But they often overlook the added value — like generating extra sales, getting protection, and fully automated reconciliation. That's where training and creating awareness come into play to communicate advantages.”